Whether you have $20 or $2,000 in your bank account, there are fundamental ways to build wealth at any age. In a world filled with bad financial advice, we’re here to break through the noise with modern-day insights and suggestions for ways to up your wealth game, even in a world of living paycheck to paycheck.

This article is Part 2 of a two-article series on building wealth. This article is written by a 30-year-old non-financial expert, and an explanation on why that is can be found in Part 1.

In Part 1 of this series, we explored the importance of educating yourself on common financial structures and how the 21st-century economy has limited the wealth-building opportunities available today. We also touched on how to recognize good financial advice from bad advice, and how advocating for yourself financially sometimes means breaking up with your current salary.

In part two, we’re navigating the world of investing and planning for retirement with a quick pit stop in behavioral psychology.

Starting a retirement fund in your late 20s or early 30s is okay!

Entering the workforce as a young adult can be an overwhelming and complicated experience. We’re so busy focusing on establishing ourselves in the workplace that the thought of mapping out an exit strategy is literally the last thing on our minds.

Starting to think about a 401(k) or Roth IRA in your late 20s is absolutely okay. Don’t let opinions or comments to the contrary guilt trip you. You have a long career ahead of you and there is plenty of time and opportunity left to get on track.

That said, the sooner you start building a retirement fund, the better of a position you will be later down the road.

Recognize your behavior changing when you make more money

There’s a term out there for what happens when you start making more money and are spending more money because of it: Lifestyle Creep.

Lifestyle Creep is what happens when you spend money on luxuries and non-essential items because – whether consciously or subconsciously – you feel that you “deserve it”. It can happen at every level of income, from minimum wage to millionaires. Specific examples can include overspending on beauty services, paying for housekeeping, flying premium instead of coach, paying for the nicer hotel room, or eating out more frequently.

Don’t beat yourself up if you realize this has happened to you, we are imperfect humans after all. Recognizing this psychological and cultural phenomenon is step one in addressing it, and step two is coming up with a plan to control it. You don’t have to cut these things out of your life altogether. Instead, come up with budgetary limits so you don’t go overboard.

You could limit your eating out to just once or twice per week. Instead of going to the spa or nail salon once a month, push it out to every six or eight weeks. Go ahead and buy that flight, just don’t waste your money on premium seats.

Preparing for the temptations of Lifestyle Creep is a powerful way to ensure you have enough money left over in your account at the end of the month to contribute to savings and retirement in a meaningful way.

Chump change still grows more than $0.00

Even if you start at the age of 30, setting aside a specific monthly amount and then slowly increasing that amount over time still helps you build a large retirement fund. After all, you have 30-40 years ahead of you to grow it. As we all know, compound interest is a powerful tool that can turn $1.00 into $2, $3 and $4 with enough time.

What’s also important to recognize about starting a retirement account is its reliance on the stock market. 401(k)s are investment portfolios in the stock market, and the sooner you start to learn about them, the better positioned you’ll be to make good choices.

While many retirement accounts will be managed by your employer or by a financial advisor, take the time to be informed on how it all works so that you can have control over how your hard-earned money is invested.

We’ll cover more about how to get started in understanding the stock market in a moment.

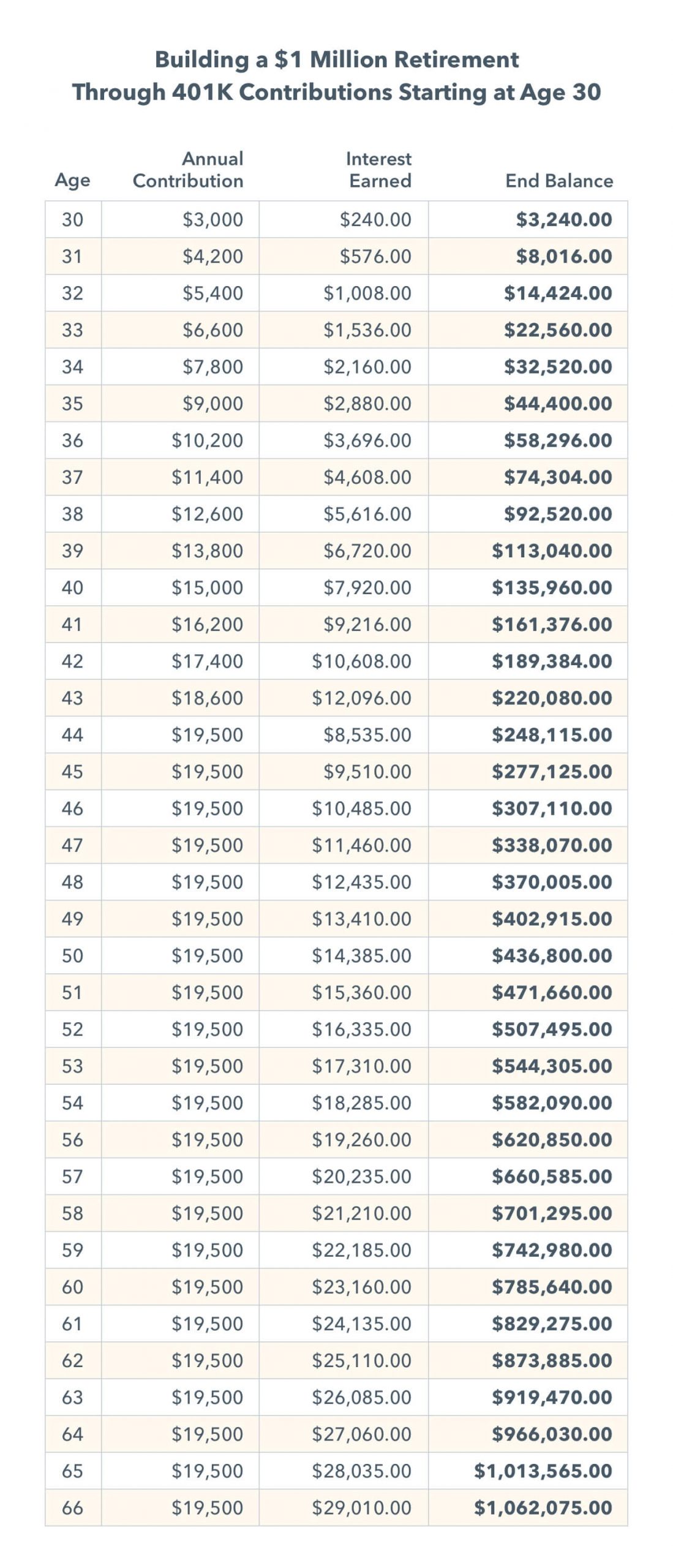

Amassing a $1 million retirement, starting at age 30

To exemplify the importance of consistent contributions and the power of compound interest over time, let’s take a look at what would happen if you started contributing a specific dollar amount per month to a 401K retirement account at the age of 30.

In the example below, a 30-year-old starts contributing $250 a month to their 401K. Then, every year they increase that amount by $100. This would mean you start at $250 per month in 2021, then you increase it to $350/month in 2022, $450/month in 2023, and so on.

Eventually, at the age of 44, you will hit the maximum annual contribution amount of $19,500 (AKA $1,625 per month).

In the example below, an 8% annual return is assumed from age 30 to 43. For ages 44 to 66, a smaller 5% annual return is assumed.

Here’s how these contributions would accumulate over time:

You read that right… that’s $1 million dollars at the age of 65. Just in time for retirement!

And 45% of it is straight interest gained. Over the course of 36 years, the original $580,000 in contributions slowly turned into $1,062,075.

Keep in mind, this chart reflects only 5% and 8% annual returns. For context, the average annual rate of return for the S&P 500 from 2011 to 2020 was 12.13%. We used 5% and 8% to err on the side of modesty as well as account for market fluctuations.

Investing has become more accessible thanks to technology

How many Americans do you think own stock today?

In the 1950s, just 4% of the population did.

Today, over half of Americans own stock, 55% to be precise.

Just like you need a checking account to have a debit card, all you need to start buying and selling funds or stocks – referred to as online trading – is a brokerage account. Some of the most common brokerage accounts are offered by Vanguard, Fidelity, E*Trade and a recently trending option called Robinhood.

Gone are the days of having to trade stocks over the phone or through a bank or financial advisor. Nowadays, buying and selling can be done from the comfort of your own device.

Another great thing technology has changed about the stock market is the cost of entry. Today, you can trade stocks for free, or pretty close to it. As recently as 5-10 years ago, buying or selling a stock would incur flat trading fees, ranging from $2-10 per trade. Nowadays, the largest brokerage firms on the market do not charge fees or commissions for trading about 90% of stocks.

For mutual funds and ETFs (explained below), it’s an industry standard to pay a very small fee to be an owner of the fund since they are intricately managed by financial experts and tend to generate solid returns. For the greater majority of mutual funds and ETFs, the annual fee is often under 1% (aka $10 or less per $1000 invested). Shop around and compare your options.

Get yourself acquainted with the basics of investing

“Anyone who is not investing now is missing a tremendous opportunity.” – Carlos Slim, Mexican business magnate, investor and philanthropist.

Investopedia summarizes the steps required in order to build wealth very simply: Make Money, Save Money, Invest Money. The last step is something that many people opt out of – especially at a younger age – for many different reasons, from fear of losing money to acknowledging they don’t know much about the topic.

The reality is, investing and participating in the stock market is the single most effective way to accumulate money and wealth outside of direct salaried or hourly work. In a close second place is real estate. Real estate investing requires much more upfront cash flow while the stock market has minimal upfront cash requirements.

And stocks are not the only type of investment available on the market. There are multiple different kinds of investments – particularly funds that are much less risky than stocks – that you can buy, including mutual funds, ETFs, and even government bonds.

All of these different types of investments can be purchased through a retirement account or with a personal brokerage account. With a personal brokerage account, you can add or take away money from the account at your leisure. With a retirement account, you cannot remove the money before the age of 55 (minimum) without paying large fees. However, you can still edit and change the funds or companies you want your retirement account to be invested in.

Lastly, stocks and funds can be purchased in partial or fractional amounts in most cases, meaning you don’t need to front the full cost of a single stock in order to be a stock owner. If a single Tesla stock is running for $800, you can buy just a piece of the stock – even just $1 – and still be considered a Tesla stock owner. Crazy right?

Investing is something that anyone can participate in. Whether you have $50 or $500.

Goodbye savings account, hello ETFs and mutual funds

ETFs (exchange-traded funds) and mutual funds are an effective and safer starting place than individual stocks for investing, and they can knock your annual savings account returns out of the water.

ETFs in particular have taken the stock market by storm in the last couple of years. In 2021, ETFs are outperforming the more traditional mutual funds with record-breaking popularity and solid annual returns.

As we covered in Part 1, finding a savings account with more than 1% interest in 2021 is like finding a needle in a haystack that is actively on fire. According to Bankrate, for July 2021, the average interest rate for savings accounts is a mere 0.06 percent.

In 2019, mutual funds in seven broad categories averaged an annual rate of return of 13%. That means if you invested $1,000 into a mutual fund at the start of 2019, you would have gained $130 in interest over 12 months. Compare that to just $10 from a 1% savings account.

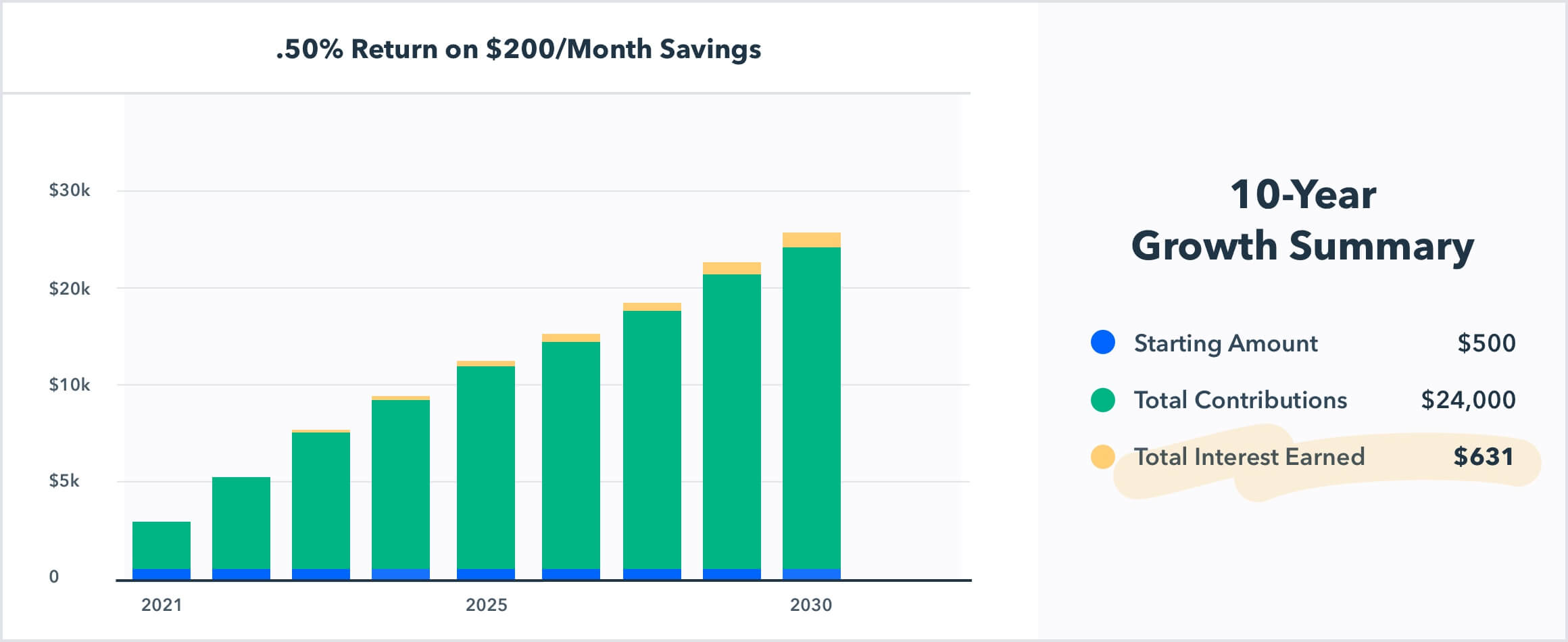

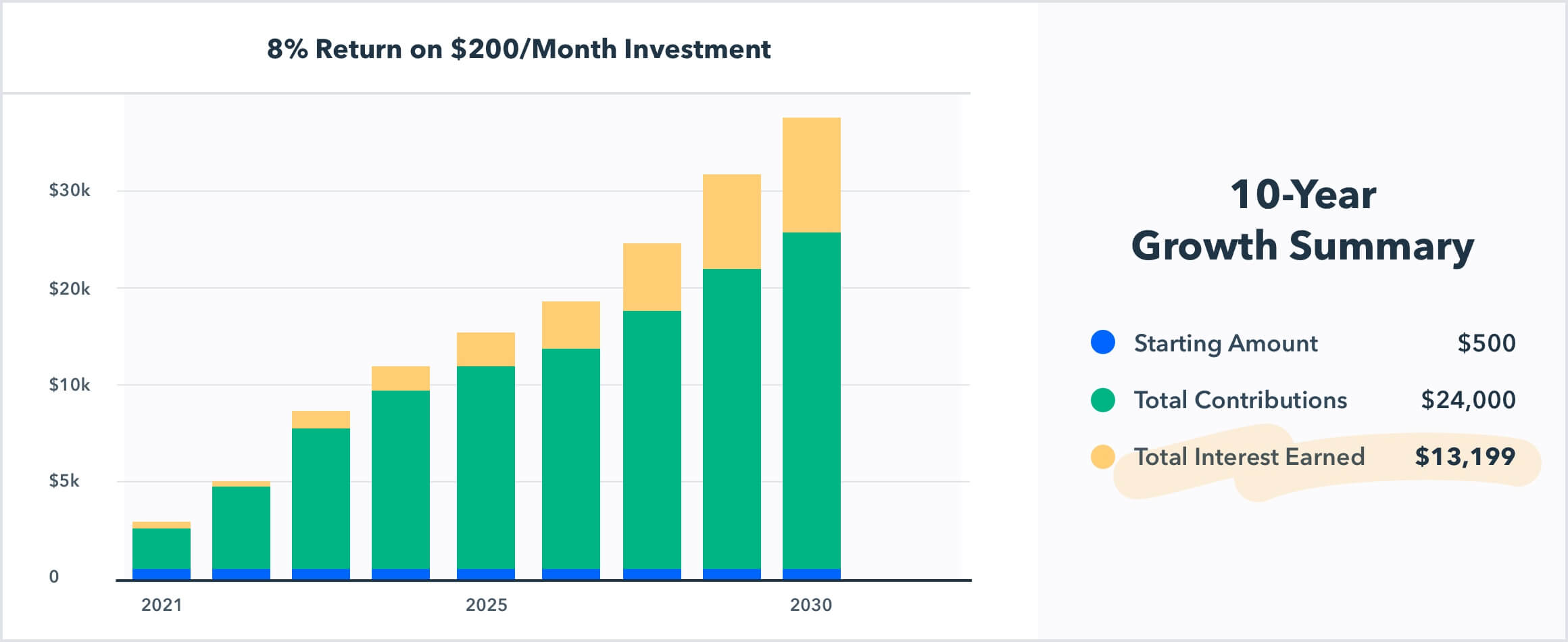

To further exemplify, here’s what saving $200 per month for 10 years looks like in a savings account (0.5% annual return) versus an investment account (8.0% annual return). We start with a $500 one-time initial investment.

While a stock is for a single company, mutual funds and ETFs are composed of multiple stocks and therefore multiple companies. Stocks are highly risky in nature because the price of the stock can rise and fall rapidly depending on the single company’s performance.

Mutual funds and ETFs have the stocks of dozens or hundreds of companies. That means when crazy market changes happen, or if a company has a bad year, these funds are impacted at a far lower rate than a single stock.

At the end of the day, mutual funds and ETFs tend to have a more stable upward trajectory over a longer period of time compared to volatile stocks that tend to have unpredictable high and low swings.

Let’s compare: stock vs. mutual fund

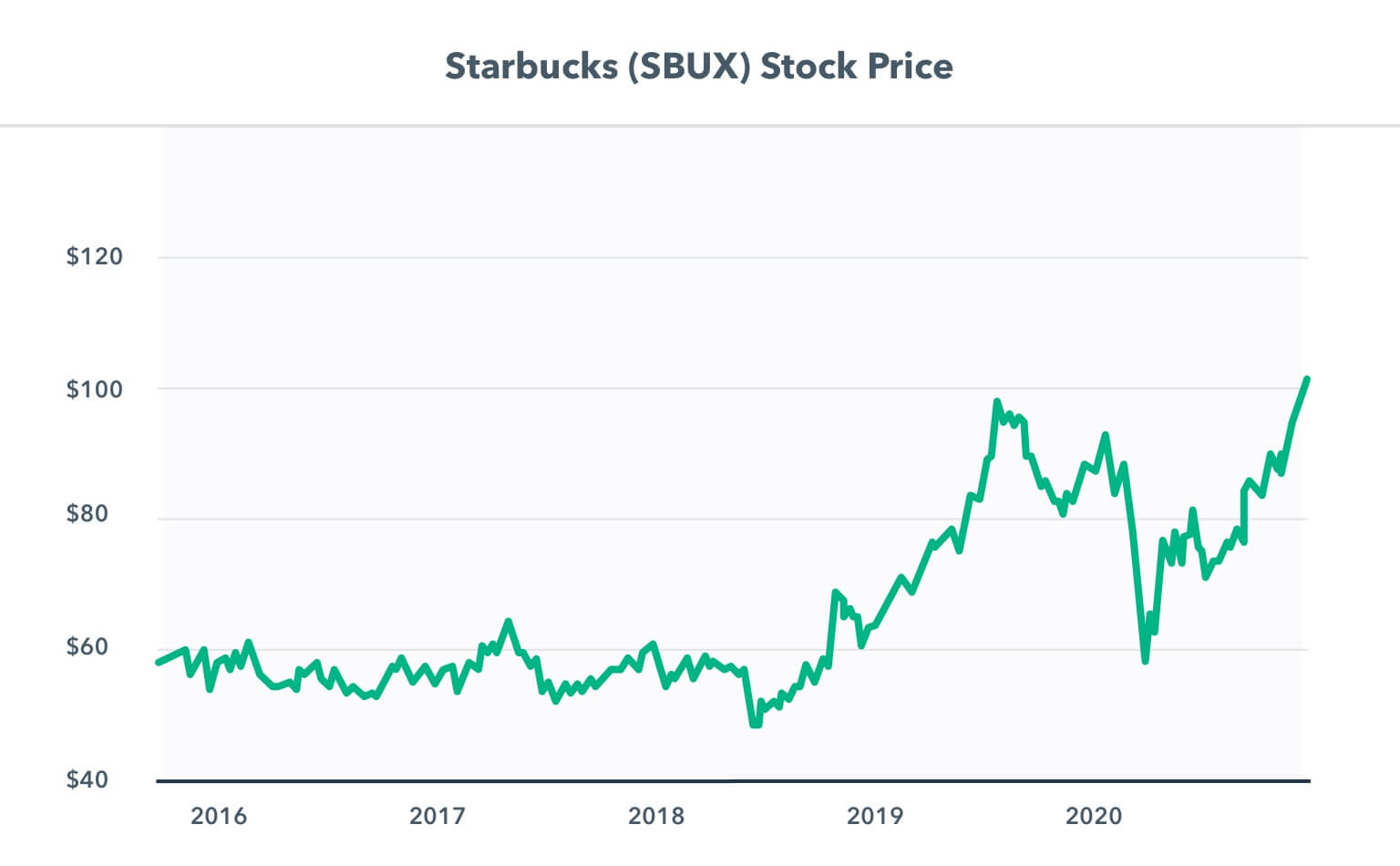

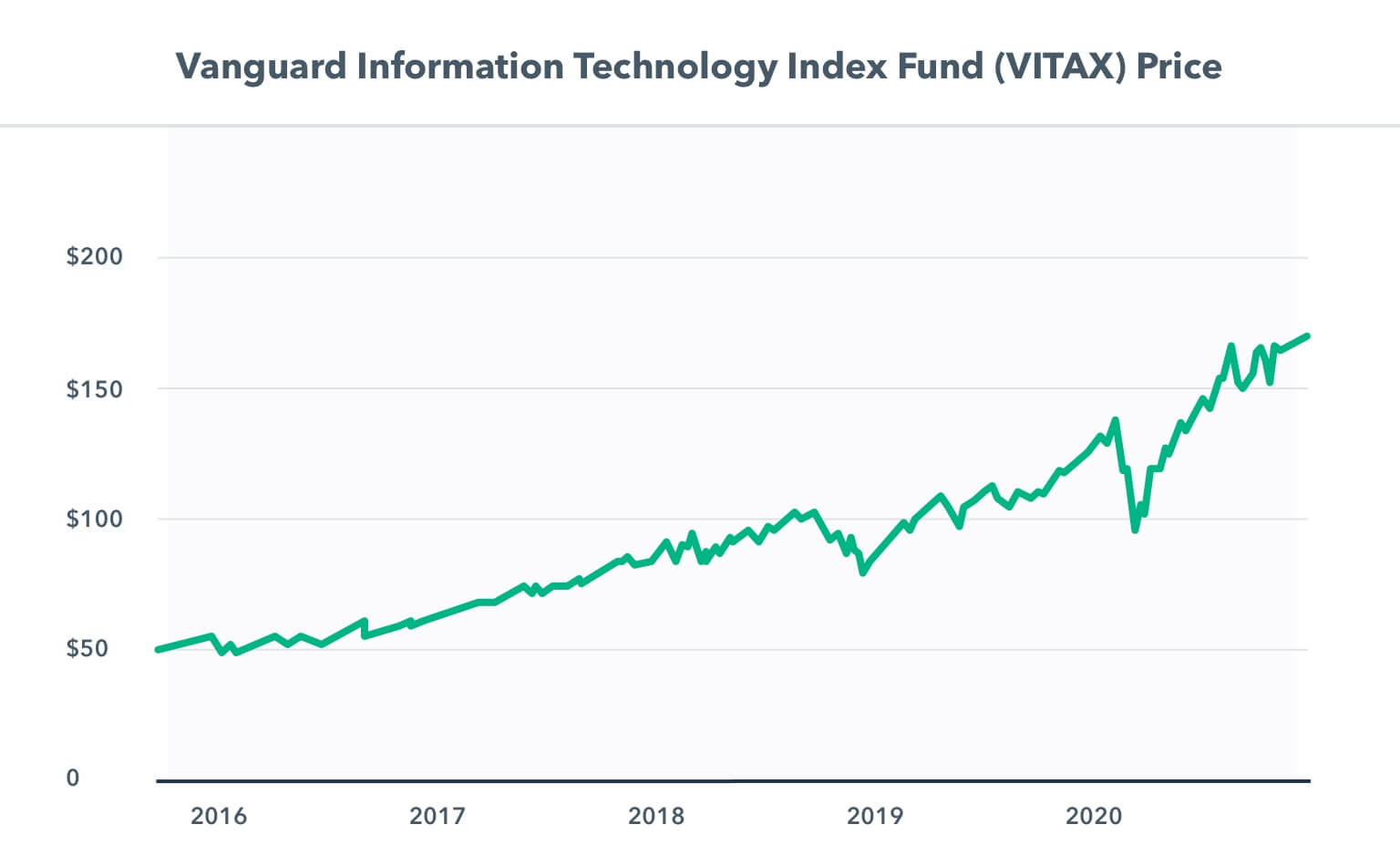

Take a look at the difference over a five-year span between Starbucks (SBUX) stock and a mutual fund called the Vanguard Information Technology Index (VITAX).

You can see that the upward trajectory of the mutual fund is far smoother and less volatile compared to the stock. The highs aren’t quite as high, but in return the lows aren’t quite as low.

While an upward trajectory like this can never be guaranteed, mutual funds continue to serve as a much safer option when compared to stocks. They are a smart long-term investment option for those who are new to the market and want to minimize risk.

Set goals & take a long-term approach to building wealth

No one should begin their journey into investing without doing a hefty amount of research first.

If your work is offering a 401(k), start there. Learn who is managing the money and what funds they are investing in. Start researching various stocks, ETFs or mutual funds and look back at their performance. You’ll start to get a grasp on levels of riskiness.

Pro Tip: Use an investment simulator for a few months before you put any of your own hard earned money into the market.

You can find a Financial Advisor at your local bank to have a discussion with on the basics of investing and to establish long term goals. Maybe you even have a friend who is a Certified Financial Advisor (CFP) that you can talk with.

Once you’re ready, setting a goal is a great way to stay on track and hold yourself accountable. Even if it’s saving something like $500 this year. You’ll be surprised at how your mentality shifts when you have long-term goals set in place.

Getting a handle on your finances can be an enjoyable journey.

All it requires is getting started.