Whether you have $20 or $2,000 in your bank account, there are fundamental ways to build wealth at any age. In a world filled with bad financial advice, we’re here to break through the noise with modern-day insights and suggestions for ways to up your wealth game, even in a world of living paycheck to paycheck.

If you’re in your 20s or 30s and thinking about ways you can bring your personal financial situation to the next level, this two-part article series is for you.

This article is Part 1 of a two-article series. Be sure to check out Part 2.

Hey, I’m April 👋 I’m a 30-year-old millennial working for the company that published this article – Pocket Prep – an educational app company.

In this article, I’m going to cover the topic of building wealth, particularly as it pertains to my generation of millennials, and maybe even a little bit for Gen Zers.

A huge spoiler alert: I am not a financial expert.

You may be asking, why on Earth would I even attempt to share financial advice then? Well, my answer is simple. I have heard a repeating narrative from countless similarly-aged friends and acquaintances over the last few years that has a singular theme to it: I will never know what it’s like to be wealthy.

From sly comments like being a senior citizen first-time home owner to never knowing what retirement will feel like, millennials are pretty good at being self-deprecating. However, that self-deprecation might accidentally be coming at a cost of our own potential. Our innate pragmatism, sarcasm, and/or humor could be accidentally and subconsciously convincing ourselves that it’s not even worth trying.

I’m here to tell you that we are hyper capable of handling the financial structures available to us today with relative ease. We can absolutely make them work to our benefit. All we have to do is just get started.

So in this article, I’m going to share some baseline and modern suggestions for getting started.

Learn more about the financial concepts that scare or confuse you

First and foremost, commit to learning more. This is something that the millennial workforce is already used to. We’re constant learners, and for the most part, we enjoy it. Like any topic you’re trying to learn, the more you educate yourself on financial structures, the more comfortable and confident you’ll feel navigating their complexity.

Choosing to procrastinate or avoid learning about complex financial concepts purely out of fear or discontent is a decision that can impede your wealth potential. How many years will you go avoiding a topic altogether until you finally sit down to learn about it and realize that it’s not that scary?

Take for instance: debt. Debt has become a truly fearful word in our society today. Thanks to predatory student loans, millennials have accumulated more debt than any other generation in history. According to a 2017 survey, 33% of millennials are so afraid of debt that the prospect of having credit card debt is more frightening to them than the prospect of dying.

There are many other financial concepts that younger people tend to avoid learning about until they have an actual reason to:

- Credit or FICO Scores

- Refinancing

- 401(K) or Roth IRA

- Annuities

- Mortgages

- Investing

- Mutual Funds

- Capital Gains

^^^ Click on each topic above to be directed to a page with basics on how they work

All of these things will be relevant in your life at some point in time, particularly if you ever want to rent a place to live (credit score), readjust an interest rate on a loan (refinancing), lease or buy a car, build a 401(k) or Roth IRA, buy a home (FICO score), or build long term savings and wealth.

The sooner you start to educate yourself on how these standard financial structures work, the better positioned you will be to make better decisions and control your own financial situation.

Understand how the economy has changed in the last 20 years

The 2008 financial crisis started a new wave of interest limitations

Today, the wealth building options and opportunities we have are incredibly different – and frankly far more limited – than what former generations had.

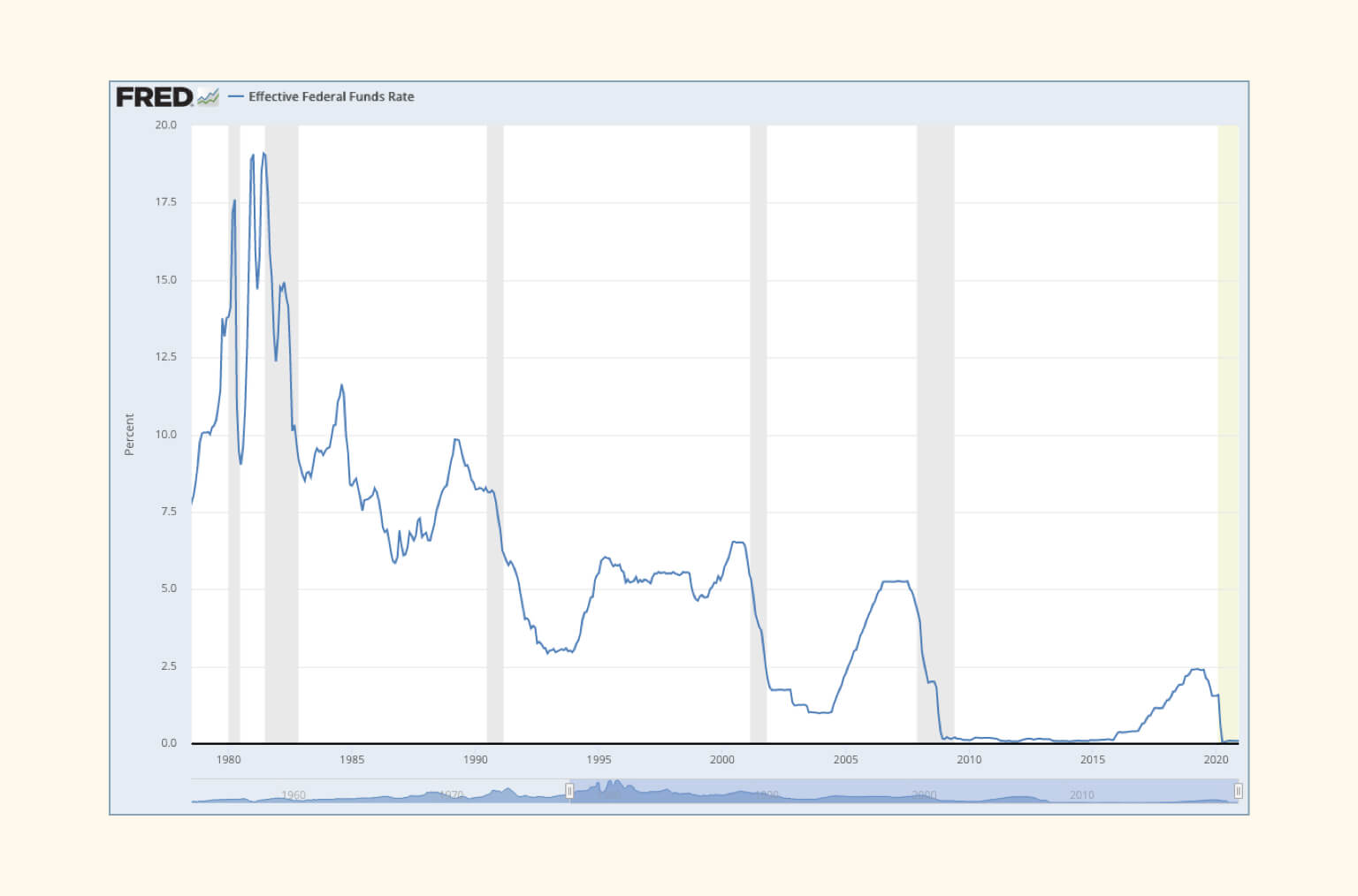

The 2008 financial crisis changed the financial structures available to consumers today in many ways. One way that the government responded to the 2008 crisis was lowering the Federal Interest Rate to historically low levels.

This is a rate that essentially determines how much money banks are required to keep on-hand for its banking customers, and in turn, it also affects how much money the bank can (or wants to) loan out to its customers.

With the Covid-19 pandemic in 2020, the interest rate once again fell down to 2008-levels.

The chart below shows the interest rate’s fluctuation since 1980, peaking at almost 20%, then dropping down to less than 1% from 2008-2016 and in 2020.

How does a lower federal interest rate affect your ability to build wealth?

It means that banks are stripping consumers of their ability to earn interest on their savings – a critical way to tap into compound interest and build long-term wealth.

A lower rate means that your bank is giving you less than 1.0% in annual interest back on your Savings Account when just 15 years ago, it was in the 3-5% range. It means that a Certificate of Deposit (CD) no longer offers the higher 5-7% rates that it once did, and it’s practically impossible to find anything over 1.5% today.

For comparison, in 1980 the average 3-month CD rate was a whopping 18%. That means if you loaned $1,000 to your bank for a CD in 1980, in just 90 days you would have earned $180 back in straight profit on your original loan.

When the increase in cost of living in the 21st century is at an average of 1-3% each and every year, this means average consumers can’t even keep up with the rate of inflation with simple, day-to-day banking options.

So, what option are we left with to increase interest on our hard-earned money instead?

The answer is investing.

We cover getting started in investing safely and responsibly in Part 2 of this series.

Be critical of where you get your financial advice from

Identify and recognize your existing biases

The topic of managing money responsibly is highly subjective. From our childhood upbringings and how our parents managed money, to watching friends or family make good or bad financial choices, we are all influenced differently by our surroundings.

Some people will be highly skeptical of credit cards because they’ve known people to rack up mounds of debt that they can’t pay off. Others will welcome the opportunity to open a new credit card because of the benefits it offers, such as travel rewards or cash back.

Before you choose to decline or participate in a new financial initiative, be sure to ask yourself: What influences have shaped my perspective on this?

Get your financial inspiration and education from present day standards

Beware of outdated financial advice; it’s everywhere.

The average down payment percentage on a home for first-time buyers is now 7%. Not 20%. A 20% down payment requirement hasn’t been the average for quite some time, but the number continues to circulate as the assumed requirement. So where you get your advice from matters.

A great example of shifting financial standards is the recommended “investment portfolio ratio”. This ratio’s purpose is to ensure that people invest wisely for retirement by investing in higher risk stocks while they’re young, then shifting to less risky bonds as they get older.

Per CNN Money, “The old rule of thumb used to be that you should subtract your age from 100 – and that’s the percentage of your portfolio that you should keep in stocks. For example, if you’re 30, you should keep 70% of your portfolio in stocks. If you’re 70, you should keep 30% of your portfolio in stocks. However, with Americans living longer and longer, many financial planners are now recommending that the rule should be closer to 110 or 120 minus your age. That’s because if you need to make your money last longer, you’ll need the extra growth that stocks can provide.”

Do your research on the people you listen to for personal finance advice. There are many “experts” out there and acting on the advice of a single person is not recommended.

A great example is Dave Ramsey. The popular radio show host and businessman is well known for the financial management advice he gives to listeners, but critics are quick to point out his advice can sometimes be woefully outdated and downright unrealistic.

Aim for aggressive income growth

Cost of living vs. average salary increases

The average pay raise in 2019 was 3.1%. When it comes to income growth, an annual wage or salary increase of 3-5% is considered fair – if not generous – to many people.

Here’s what that 3-5% doesn’t actually account for: genuine salary growth outside of a rapidly increasing cost of living.

The cost of living rose by 2.8% in 2019 and is on track to continue in an aggressively upward trajectory. A report released in 2019 found that when adjusting for inflation, adults aged 25 to 34 have only seen a mere $29 income increase from 1974 to 2017. This report also found that the median price of homes in that same time period rose a whopping 39%.

Needless to say, annual salary averages from the last few decades have not kept up with a growing cost of living.

An annual 3-5% salary growth just simply will not cut it for the majority of people. Not only will it not be enough to live a comfortable lifestyle – defined in this case as all bills paid and having the ability to afford hobbies or interests – but it doesn’t support a healthy retirement plan either.

The magic number that many people refer to as a standard goal for a successful retirement fund at age 66 is $1 million. But the true value and lifespan of that number varies greatly by geographic location.

A report done by financial tech company SmartAsset found that a $1 million retirement fund would deplete in 10.21 years in New York City, but it would last for 32.26 years in McAllen, Texas.

Yet another thing millennials have ruined: acquiescence

Millennials have long been aware of the rising cost of living and compensation growth imbalance, and in turn, they’ve been aggressively labeled as job hoppers, allegedly uncommitted or unattached to organizations or instructions. While opinion editors insist this generation has no manners and is on a crash course to spend their retirement funds on avocado toast, the reality is far more rational.

Millennials just want to be paid a fair wage. They want their salary to keep up with inflation and increasing costs of living and also contribute into a 401K while having a decent quality of life.

“The typical job change comes with about an 8 to 10 percent pay increase,” according to PayScale. “Earning as much as 20 percent more isn’t considered out of the question.”

AKA, staying at the same job forever is detrimental to one’s salary potential.

A 2019 spotlight article by MarketWatch told the story of a 29-year-old increasing her salary by $22,000/year by simply switching employers.

“I had this job for five years, but I wanted something new and believed I was being underpaid,” Jordan Bradford said. “I now have the same role and same title, but I’m making $22,000 more,”

A crucial tip for getting ahead in building personal wealth is to regularly assess your salary level and establish short-term and long-term goals for where you want to be, then map out the steps you need to get there.

Next up: tricking your brain into saving more & how to invest wisely

In the second installment of this wealth building series, we dive into the behavioral science and day-to-day minutia of what it means to invest safely, and how investing is something anyone can – and should – do.